Financial Opportunity in Your Community

LISC’s Financial Opportunity Center® (FOC) program partners with community members from underinvested neighborhoods to build family-sustaining careers and achieve financial success.

Residents work side-by-side with FOC coaches to identify, make measurable progress towards and achieve their goals through connections to employment services, greater financial health, and household income supports. LISC supports trusted community-based organizations to adopt the FOC model and provides them with data-based insights, technical assistance, training and peer-learning groups.

Financial Opportunity Center® Model

LISC's FOC sites partner with low- to moderate-income community members to focus on their financial bottom line with integrated delivery of employment services, financial coaching and accessing income supports.

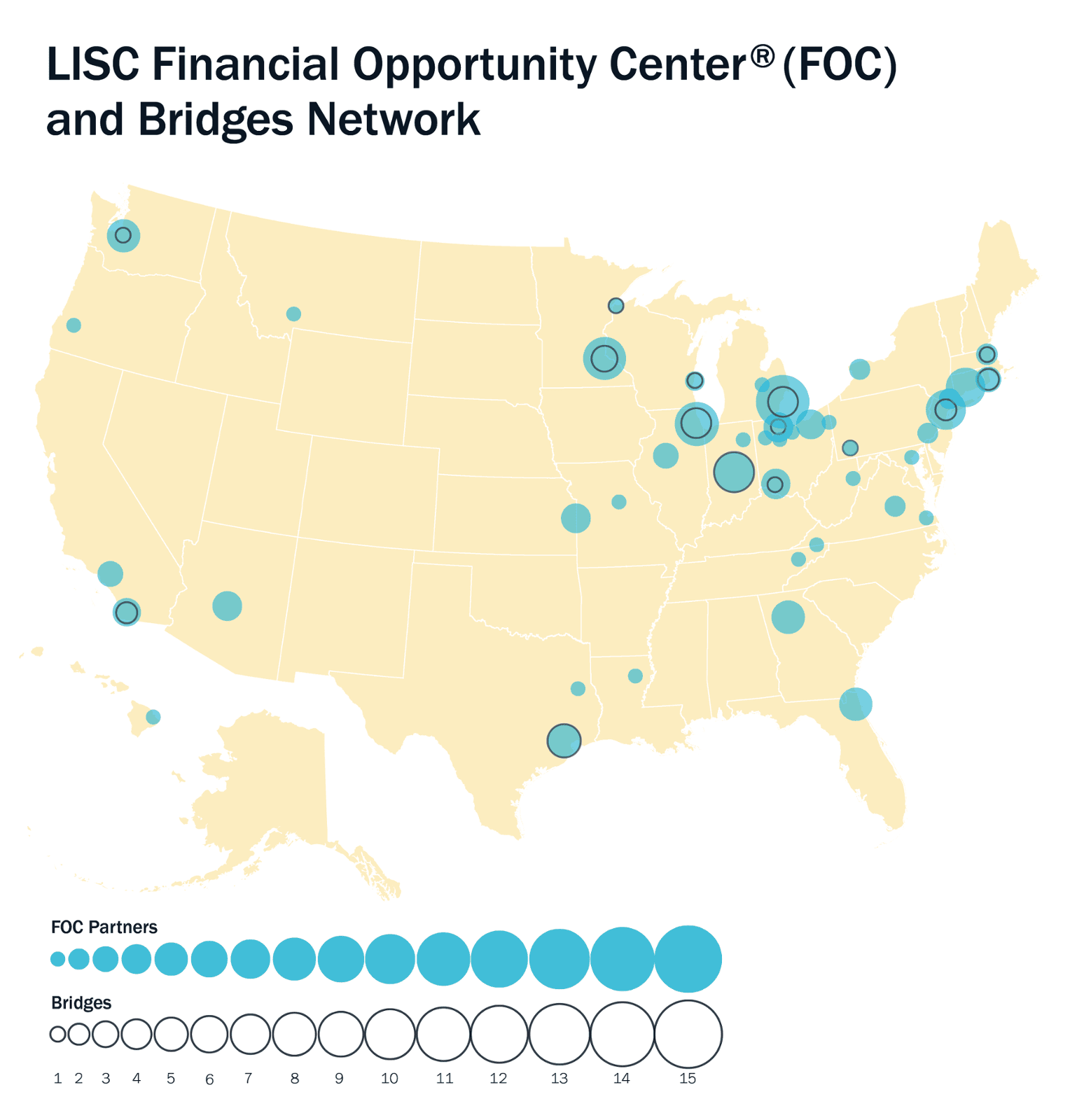

LISC supports a national network of 120 FOC in more than 30 cities across the country. In these centers, community members work with coaches to set goals, and chart and track their way towards their goals be it a better job, improved credit, saving for a house or a rainy day fund.

The FOC model involves integrated delivery of three "core" services:

Employment Services- Job readiness, employment training, and assistance looking for job are essential parts of what is offered at a Financial Opportunity Center® site. A job and opportunities for advancement are the platform that supports a family's financial well-being, and employment services are the initial reason many clients begin working with an FOC.

Financial Education and Coaching helps clients do a better job in how they handle their money. The goal is for a family to examine their savings and spending habits to see if they can make positive changes that improve their credit scores and stabilize and grow their assets.

Income Supports Access can be crucial for giving a worker the time and income necessary to fulfill training to reach a better paying position and career. Coaching helps clients work through the disjointed network of public benefits and helps individuals access all of the services and supports for which they are eligible.

The Financial Opportunity Center® model is not a distinct program or organizational entity, but rather, a new way for agencies to conceptualize and approach their work. As such, the model is deployed within the existing infrastructure of established, community-based institutions that have a track record of providing at least one of the three core services (and, in the case of most FOC site, a multitude of other social, financial or educational services).

In LISC's experience, neighborhood-based organizations have the advantages of convenience, familiarity, accessibility and cultural competency. They offer the trust and credibility that are crucial to establishing productive, long-term relationships with community residents. Across the country, a wide spectrum of neighborhood-based nonprofits—workforce agencies, faith-based organizations, Community Action Agencies, multi-service providers, housing counseling groups, prisoner re-entry programs and community colleges—have incorporated the Financial Opportunity Center® model into their programming.

**In several LISC cities that were early adopters of the model, the sites are still known locally as CWFs, though they are part of the FOC network and Financial Opportunity Center® model is the national LISC "brand."

Click here for more on the Elements of a Successful Financial Opportunity Center® program.

Bridges to Career Opportunities

Bridges to Career Opportunities

In the Bridges to Career Opportunities (Bridges) model, clients working with LISC’s national network of Financial Opportunity Center® programs can ramp up foundational literacy and math skills, get technical training and pursue certifications for a particular industry.

The Bridges to Career Opportunities initiative is a model that is integrated into many Financial Opportunity Center®programs. Neighborhood residents can take advantage of:

Math, reading and/or English remediation that is industry-specific and relevant to the career track a client is pursuing. This puts adult learners on a “fast track” to upgrade or refresh their skills as preparation for technical training.

Vocational training at an FOC agency, community partner or local community college.

Job-hunting skills that include resume-writing, interviewing and dressing professionally.

“Soft skills” for the workplace like communication, conflict resolution and time management.

Understanding of the field, such as pay and hours, work expectations

Ongoing support from FOC employment and financial coaches to set and achieve personal goals.

Bridges to Career Opportunities is a supported career training program that helps overcome the gaps in academic readiness that can prevent low-wage, low-skill adults from being hired and succeeding in careers that offer livable wages. Many workers are unable to participate in occupational skill training, which teaches workers specific capacities so they are prepared for employment in an industry or field, because they lack the necessary literacy and math skills and have financial challenges that undermine their ability to commit to longer-term training and career development. Bridges is designed to address both these issues.

Bridges provides effective adult basic education contextualized for strong local industries like healthcare and advanced manufacturing. Participants learn foundational skills such as math, literacy or English as a Second Language in the context of their intended occupation. As important, Bridges to Career Opportunities helps participants manage the financial and logistical challenges that can interfere with job training.

Client Services & Coaching

Running a Financial Opportunity Center® site and using the Integrated Services Delivery model with coaching for financial, employment, and income supports will often require new models for working with clients and new information about opportunities or ideas for them, as well.

Salesforce

These LISC materials provide detailed information for how to use Family Financial Tracking™ (FFT) in Salesforce, including step-by-step guides to entering data into the system. The page also includes FFT Salesforce forms that staff can use for client administration.

Operations

These materials help an agency with the paperwork necessary for back office administration of staff including templates for agencies to use to create and advertise jobs at an FOC site, such as an overview, position description and preferred qualifications.

Webinars

The LISC Family Income and Wealth Building team periodically offers webinar trainings on a variety of topics connected to Financial Opportunity Center®programming. All webinars are recorded and held in our archive.

RESOURCES

The goal of this website is to gather and curate materials, supporting documents and ideas that can be used by LISC staff and partners at community-based organizations across the country that are interested in or already operating a Financial Opportunity Center® (FOC) site. The site has resources for practitioners who work directly with clients, staff who design and administer the programs, and advocates who help provide support.

New to the FOC network? Click below for key steps to getting started.

About LISC

Together with residents and partners, the Local Initiatives Support Corporation (LISC) help forge resilient and inclusive communities of opportunity across America–great places to live, work, visit, do business and raise families.

Sharing our expertise of 30-plus years, we bring together key local players to take on pressing challenges and incubate new solutions. With them, we help develop smarter public policy. Our toolkit is extensive. It includes loans, grants, equity investments and on-the-ground experience in some of America’s neediest neighborhoods.

We know that healthy, sustainable communities are made up of people who have living wage jobs and feel confident about their economic futures. To get there, residents need the skills to advance along the path of employment and manage their money well. That’s why LISC invests in helping people tackle all the facets of financial life—earning a steady pay check, budgeting, building good credit and saving for education and retirement. To learn more, visit the LISC website